How to use this module”Expense Management”

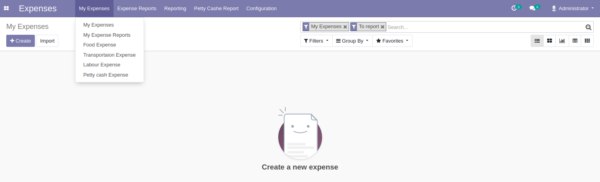

In addition to regular expenses, we have specific menus for food, transport, labor, and petty cash expenses.

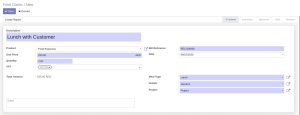

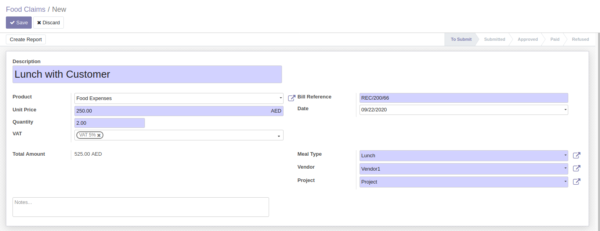

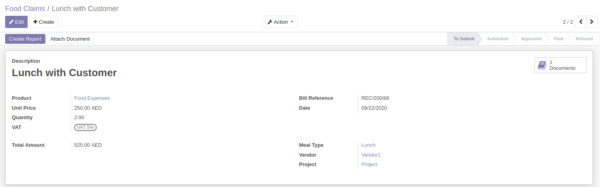

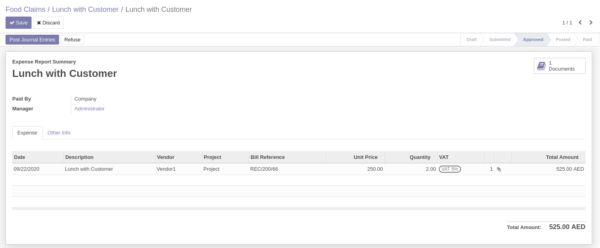

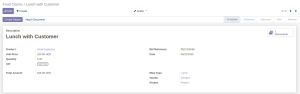

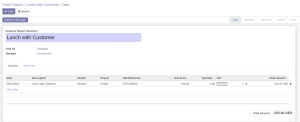

Food Expenses: In adherence to best business practices, it is often advisable to monitor food expenses separately. In such cases, this module efficiently tracks all food-related expenses incurred.

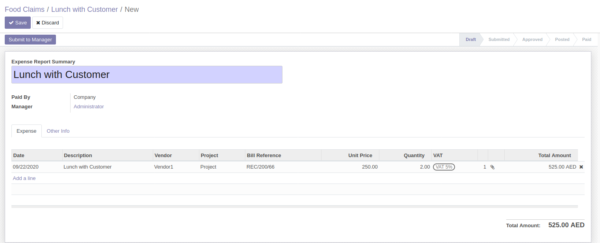

Clicking the “Submit to Manager” button will send the report for approval, transitioning its status from draft to submitted.

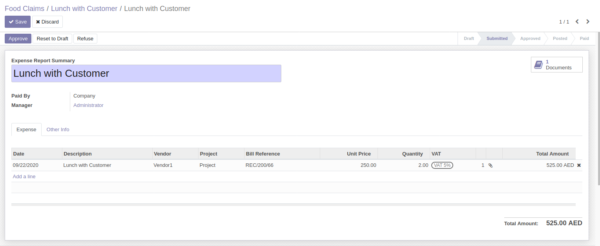

After reviewing the food expense report, the responsible manager can either approve or reject the report. Clicking the “Approve” button changes the status to approved, making it ready for posting journal entries.

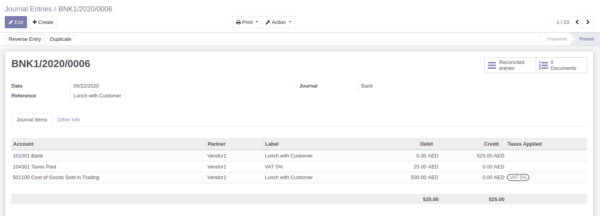

The “POST JOURNAL ENTRIES” button will record the expenses in the corresponding accounting entries.

You can view the relevant posted journal entries for food expenses in the accounting module.

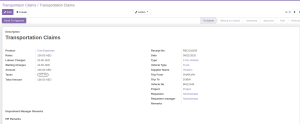

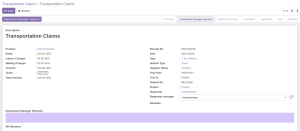

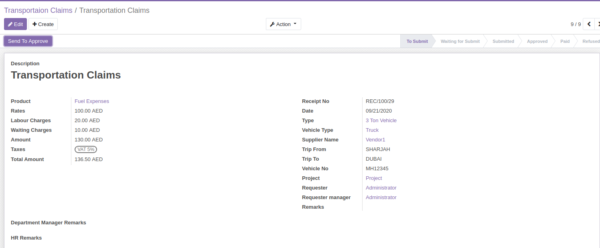

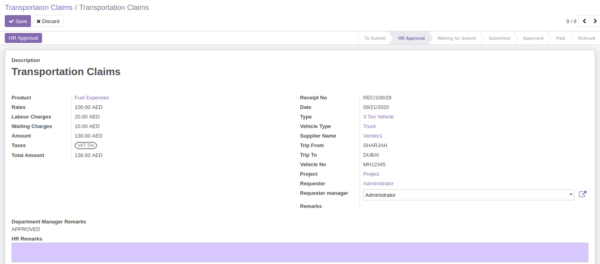

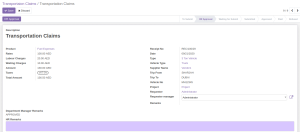

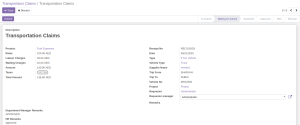

Transportation Expense: The transportation expenses module efficiently records the specific costs incurred by employees during business travel. It allows tracking of expenses related to business trips, including taxi fares, parking fees, fuel expenses, and more.

As depicted in the image, the transportation expenses module provides detailed information, including:

– Labor charges

– Waiting charges, if applicable

– Type of vehicle used

– Vehicle number

– Trip details

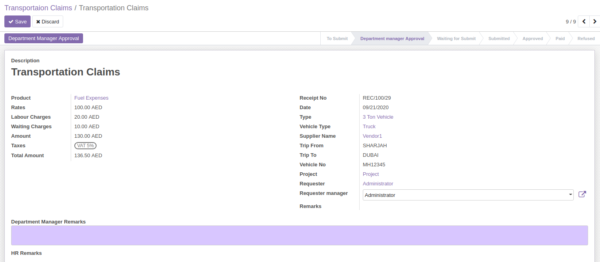

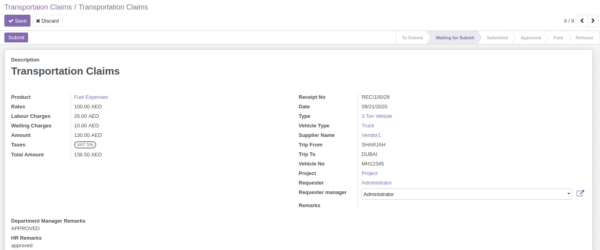

Once the necessary details are filled in, transportation claims are submitted for approval. This streamlined process aids in cost analysis without any confusion.

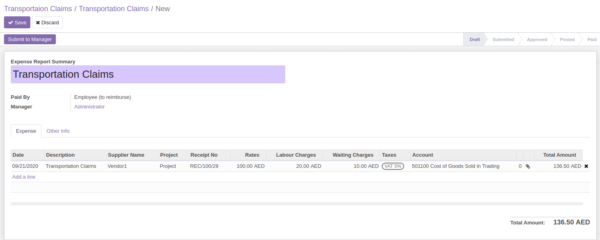

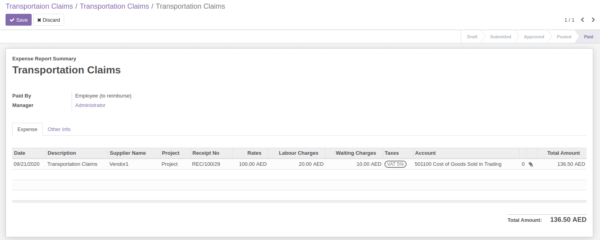

Finally, the report is sent to the accounts department. Once the expenses are verified, the accountant can make accurate payments and post the journal entries accordingly.

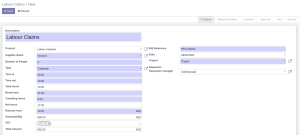

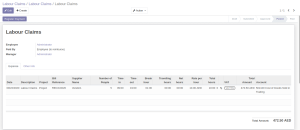

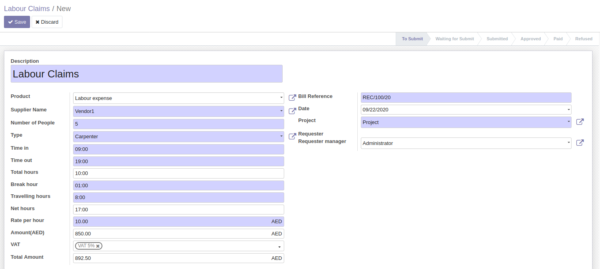

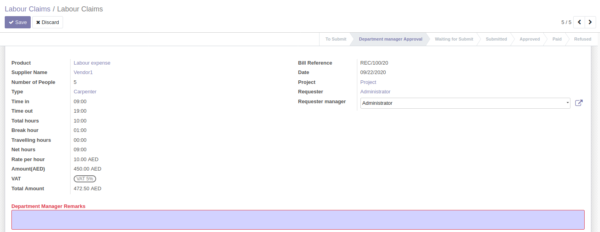

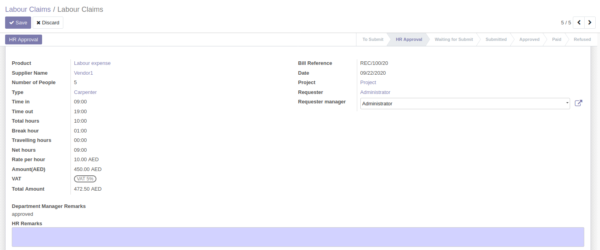

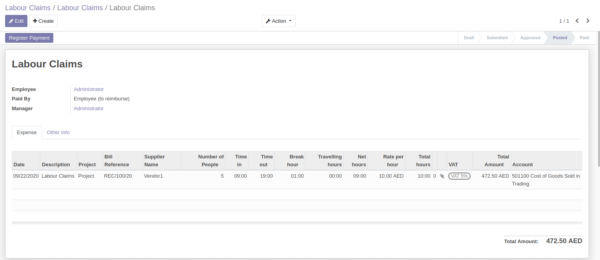

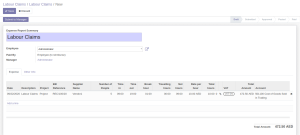

Labor Expense: The labor expense feature is designed to provide concise and transparent information regarding all expenses related to labor costs.

This labor section includes the following details:

– Product: Describes the type of expense it is related to.

– Supplier: Specifies supplier names, if applicable.

– Number of People: Indicates the count of individuals working on a project.

– Type: Represents the category of labor involved.

– Time In: Records the start time of the labor work.

– Time Out: Records the end time of the labor work.

– Total Hours: Calculates the total hours worked based on the time in and time out.

– Break Hour: Specifies any break taken by the labor.

– Traveling Hours: Records the time spent traveling for the project, if applicable.

– Net Hours: Net hours represent the total working time, including traveling time and excluding break time.

– Rate Per Hour: Indicates the payment amount for each hour of work.

– Amount:Calculates the total payment considering the working time, rate per hour, and break time.

– VAT: Specifies the tax amount, if applicable.

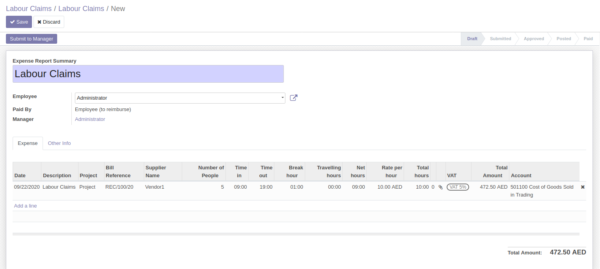

Once all the managerial approvals are completed, the system generates a report for the accounts department to verify. This report includes details such as the employee to whom the payment needs to be made, the payment mode, the relevant department manager, and the expense lines.

The accountant verifies the details, and upon approval, they proceed with the payment and post it in the related journal entries.

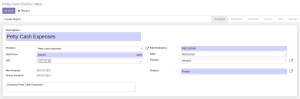

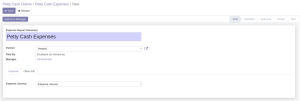

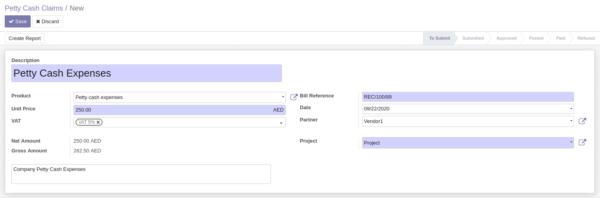

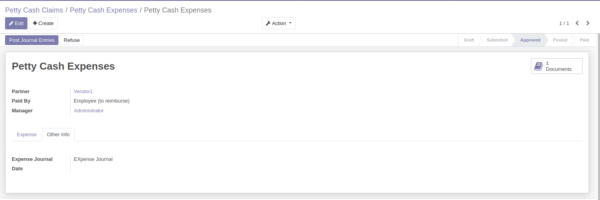

Petty Cash Expense: Petty cash expense management enables the recording and tracking of petty cash usage within the business. It handles small expenses that arise during daily operations.

The petty cash holder allows users to enter project-related expenses, recording the incurred costs. The system then calculates the net and gross amounts accordingly. The net amount represents the cost excluding VAT, while the gross amount displays the total after VAT deduction.

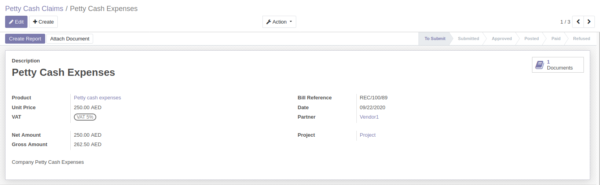

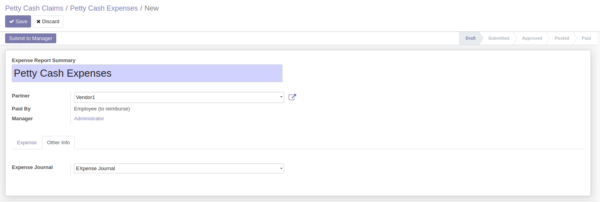

Documents or related receipts can be attached using the “Attach Document” button. Once the documents are attached, the system displays the number of documents linked to the expense. Clicking on “Create Report” generates a report that needs to be submitted to the accounts department.

The accountant verifies the information, and upon approval, they can post the journal entries and proceed with the payments. These entries are recorded in the respective journals, ensuring precise record maintenance.

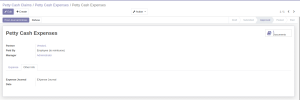

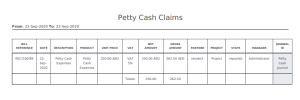

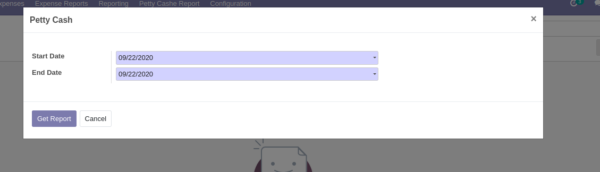

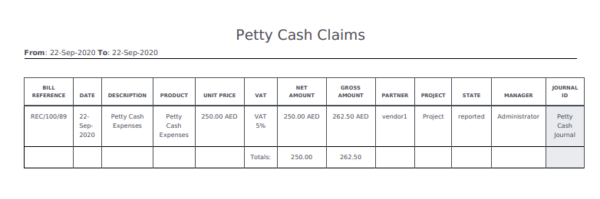

Petty Cash Report: This report provides a detailed summary of petty cash transactions, offering insights into expenses and helping maintain accurate financial records.

An extensive and crucial feature of this module is the petty cash report, offering a dynamic overview of all expenses managed as petty cash.

It offers an excellent overview, allowing you to verify if the entries are posted correctly in the cash journals and enabling effective and streamlined analysis.

Reviews

There are no reviews yet.