How to use this module”Deferred Revenue & Expenses”

$99.46

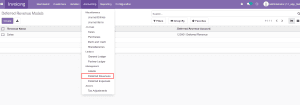

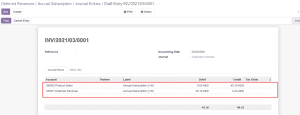

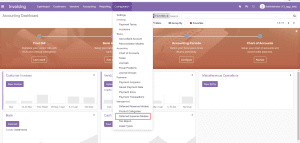

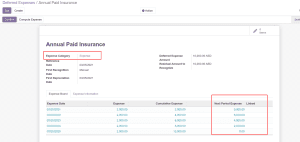

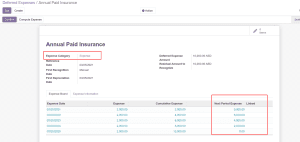

Experience financial freedom with our Deferred Expenses and Prepayments management module, designed to handle costs that have already been incurred for products or services yet to be consumed. These costs are valuable assets for your company, representing payments made for future goods and services. However, they cannot be reported in the current Profit and Loss statement as they will be expensed in the future. Our module streamlines the management of these deferred expenses and revenues, ensuring efficient handling and accurate accounting.

**Key Features:**

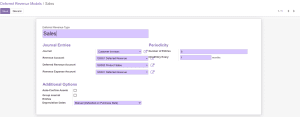

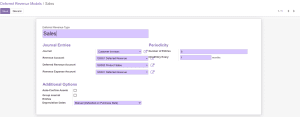

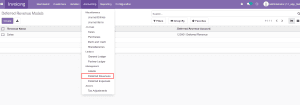

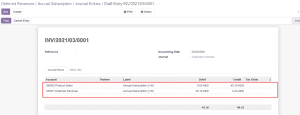

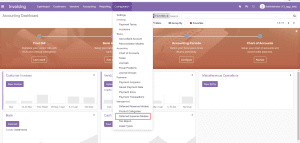

1. Deferred Revenue: Manage revenue streams that are earned but not yet realized, ensuring accurate future financial reporting.

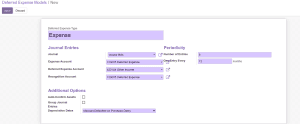

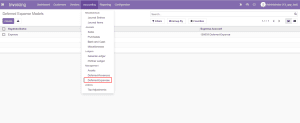

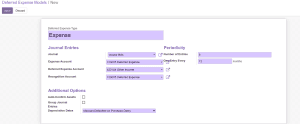

2.Deferred Expense: Effectively handle costs incurred for unconsumed products or services, maintaining precise accounting records for future expenses.

Embrace financial foresight and enhance your business’s financial health with our Deferred Expenses and Prepayments module. Stay ahead of the curve and manage your assets wisely.

There are no reviews yet.

Reviews

There are no reviews yet.