How to use this module”HR Payroll Transactions”

Before installing this module, make sure hr_payroll_community is installed.

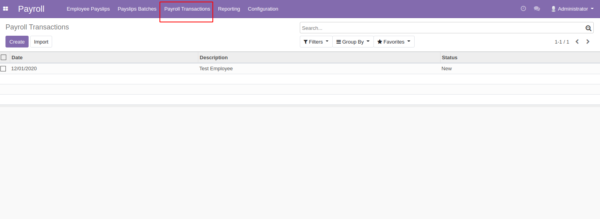

This module depends on base modules such as hr, hr_payroll, hr_timesheet. After installing this module a separate menu named payroll transactions will be added in the payroll module.

1. Configuration

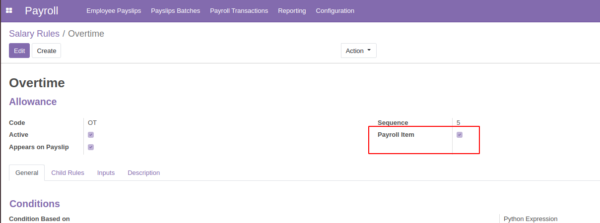

To begin with, it is essential to configure certain settings to ensure the module functions correctly. Within the configuration menu, you will find salary rules. Navigate to the salary rule menu and create a new salary rule.

In this section, we have the flexibility to specify each addition, deduction, overtime, or any other type of payroll transaction individually that we intend to incorporate. It is essential to ensure that the Payroll Item is selected to enable this salary rule’s visibility in our payroll transactions. You have the freedom to define your own Python expressions, considering the variations between different organizations.

2. Time-sheet Cost:

Go to employees menu and under Hr settings tab, go to Time-sheet cost

To calculate overtime in payroll transactions, it is necessary to specify the time-sheet cost in the employee form. Overtime cost will be computed based on the employee’s time-sheet cost multiplied by the number of hours worked.

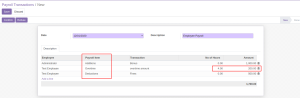

3. Calucations Of Payroll Transactions

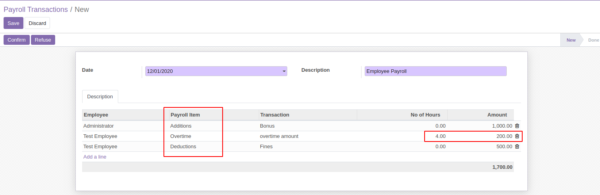

a) Specify the month for which you want this payroll transaction to be recorded.

b) Employee: You can select more than one employee for the transactions.

c) Payroll Item: These payroll items are derived from salary rules where the “Payroll Item” Boolean field is checked.

d) Transaction: You provide specific details, such as the type of additions or deductions you plan to include, such as bonuses, fines, etc.

e) Number of Hours: This is applicable only when there is overtime for employees. After entering the number of hours, the amount will be automatically calculated along with the time-sheet cost.

f) Amount: Here, you can specify the amount to be added or deducted from the payroll for the respective employees.

After providing the necessary information, the HR manager has the ability to confirm the transactions, transitioning the state from “New” to “Done.” If any corrections are needed, the HR manager can click on “Refuse” to reset the form to draft status for editing. The total of all values can be viewed at the bottom of the form.

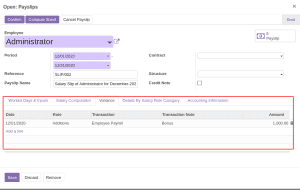

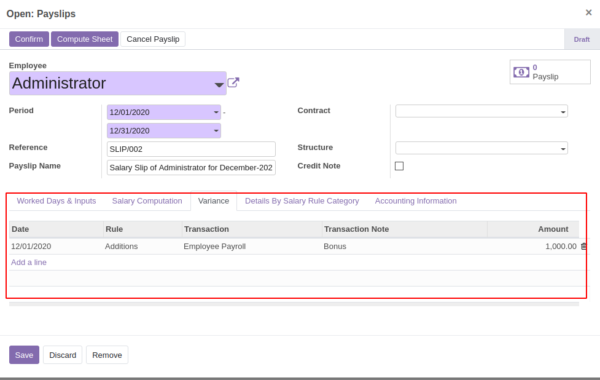

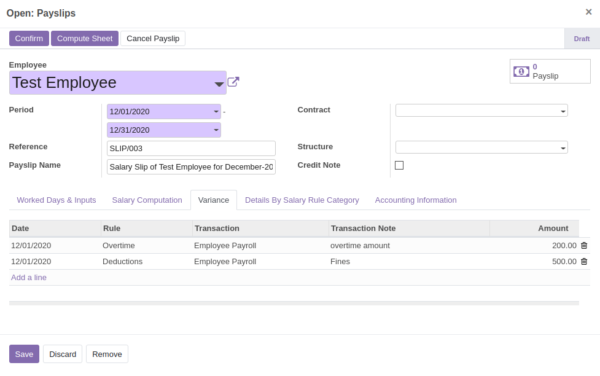

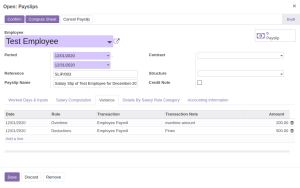

4. Employee Payslips:

In the image above, a dedicated tab labeled “Variance” is established to record the additions and deductions specified in the payroll transactions. This information is segregated individually for each employee. All values for additions and overtime are summed in payslips, while values for deductions are subtracted. The net salary is then calculated based on these calculations.

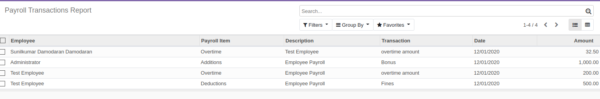

5. Payroll Transaction Report:

The Payroll Transaction Report can be accessed from the Reporting menu. It enables the tracking and analysis of additions and deductions, providing details on amounts and dates for thorough examination.

Reviews

There are no reviews yet.