How to use this module”Asset Sell Or Dispose”

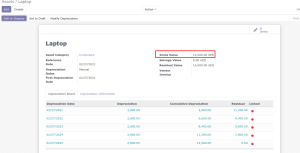

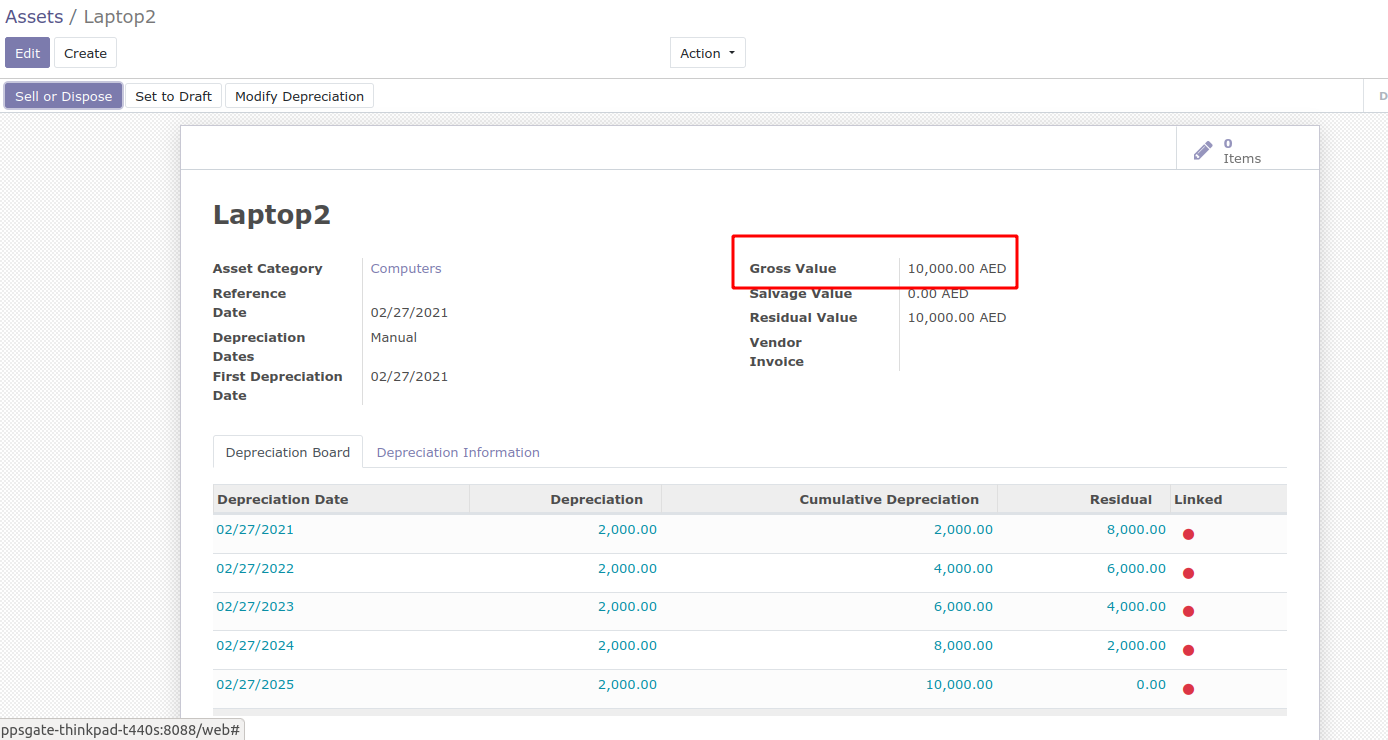

Currently, within the accounting menu, an asset entry for the Laptop has been generated, with a gross value set at 14000. This indicates our intention to sell the laptop at this price.

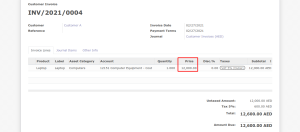

In this scenario, when selecting the “sell” option in the action menu, we can generate an invoice for the specific asset. Automatically, the Gain Account is displayed. This occurs because the invoice value is 12000, whereas the gross value is 14000. Given that we are selling the asset at a higher price than it was purchased for, the surplus amount will be posted in the Gain account.

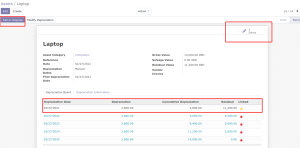

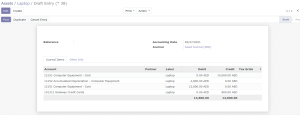

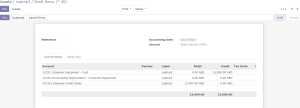

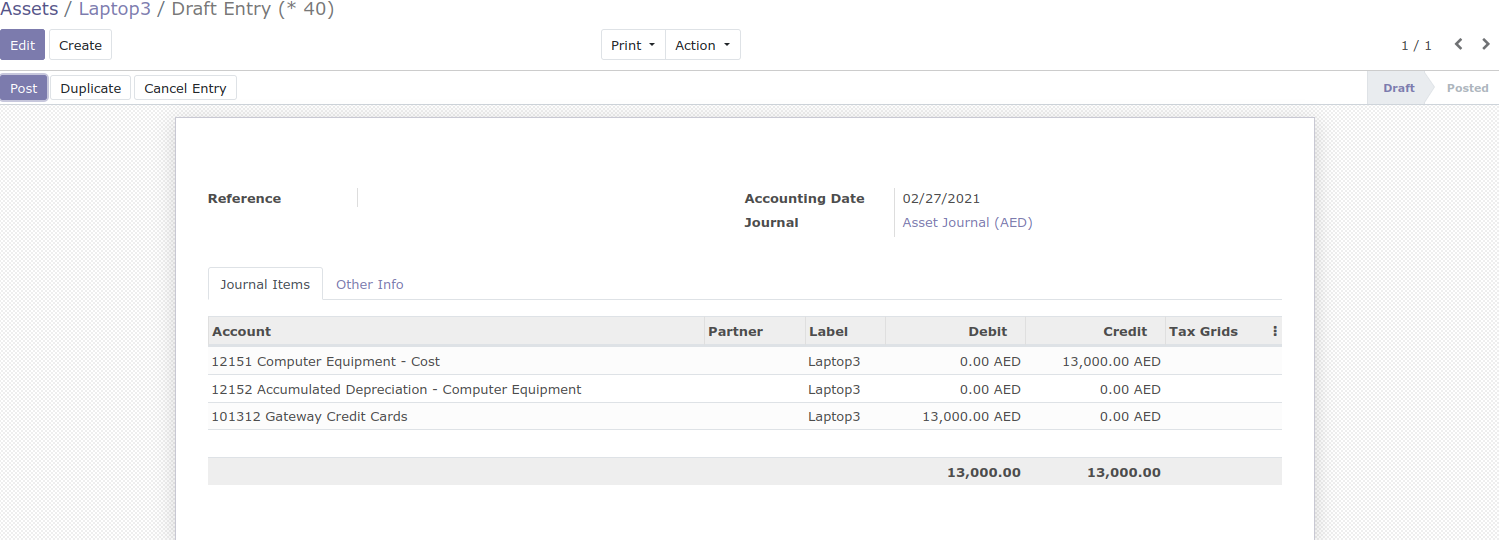

After posting the entries, the state will be changed to “closed,” and two journal entries are generated: one that was manually posted and another automatically created entry after the sale.

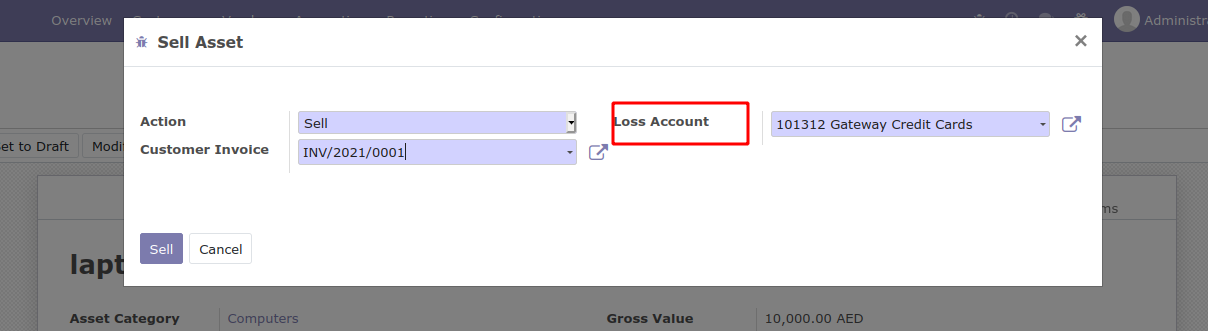

In this case, the difference will be recorded in the Loss Account when selecting the “sell” or “dispose” option.

Additionally, besides selling, there’s an option to dispose of the asset when it is no longer needed. You can select the “dispose” option from the action menu to initiate the disposal process for the asset.

Reviews

There are no reviews yet.